Diversification and Correlation

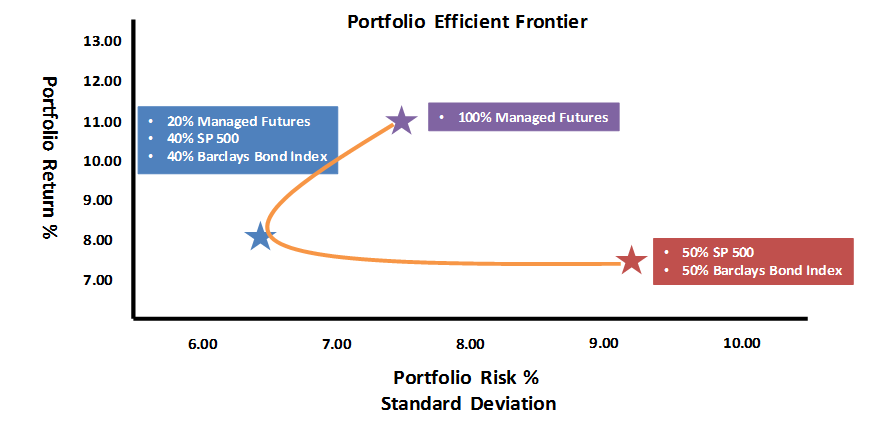

- We believe that a Managed Futures allocation that adds diversification can potentially enhance portfolio returns, lower volatility and benefit an overall portfolio in periods of market dislocations such as rising interest rates, and/or volatile equity environments.

- A diversified portfolio may perform better and be less volatile when they include Managed Futures, despite the fact that some standalone returns from Managed Futures can be volatile.

- Correlation benefits can be achieved because certain managers returns tend to be uncorrelated with those of most other asset classes

| SP 500 | Barclays Bond Index | MSCI World Index | CTA Index | |

|---|---|---|---|---|

| SP 500 TR | 1.00 | |||

| Barclays Bond Index | 0.08 | 1.00 | ||

| MSCI World Index | 0.93 | 0.10 | 1.00 | |

| CTA Index | -0.003 | 0.18 | -0.07 | 1.00 |

*Past performance is not indicative of future results. Correlation based on period from Jan 1994 to Sep 2015. Data from Barclay Hedge and Autumn Gold databases.

- We believe the most appealing feature of certain CTA managers is their ability to provide a compelling risk adjusted rate of return coupled with the optimum level of diversification at the greatest time of need.

*Data from Barclay Hedge and Autumn Gold databases. Past performance is not indicative of future results. Benchmarks being used for illustrative purpose.

Diversification attempts to maximize returns for a given amount of risk.